Vietnam’s textiles and footwear would gain strongly from the TPP, after exports of $31 billion last year for brands such as Nike, Adidas, H&M, Gap, Zara, Armani and Lacoste. Photo by Reuters.

Among garment exporters, Vietnam has faced the worst hit from the the Uyghur Forced Labor Protection Act (UFLPA), a Reuters review of official U.S. data showed. The law, in place since June, requires companies to prove that they do not use raw material or components produced with Xinjiang’s forced labor.

The U.S. clampdown hurts as it comes on top of a drop in clothing demand from richer nations that has already dented industrial output and exports from the Southeast Asian manufacturing powerhouse, a major supplier to big brands such as Gap, Nike and Adidas.

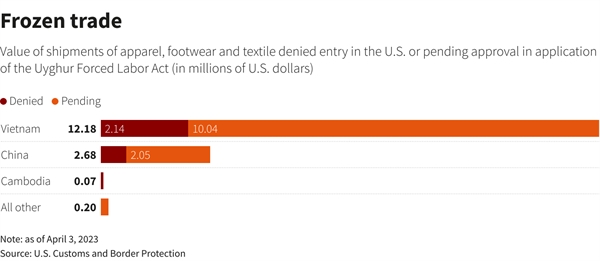

Of the $15 million worth of apparel and footwear shipments held up for UFLPA checks more than 80% were from Vietnam, and only 13% of its cargoes were cleared for entry, U.S. customs data up to April 3 showed.

|

Many U.S. importers are still sanguine, but their supply chains could still be disrupted as Vietnam’s apparel makers depend on China for about half of their input materials, according to the country’s industry association.

Vietnamese manufacturers, trade associations and the industry ministry did not reply to Reuters questions about the impact of UFLPA.

The value of shipments from Vietnam that have been denied entry to the U.S. exceeded $2 million, three times more than those from China – with the sanctions having increased exponentially in the first months of this year.

While U.S. controls have been far more frequent for the electronics industry, especially for solar panels which could be made with polysilicon from Xinjiang, only 1% of electronics cargoes checked were denied entry, as opposed to 43% of apparel and footwear shipments.

In total, customs checked nearly 3,600 shipments worth more than $1 billion from a range of countries to ascertain they did not carry goods with input from forced labor in Xinjiang, U.S. customs data showed.

XINJIANG LINKS

While the halted shipments represent a tiny portion of the $27 billion worth of garments and footwear Vietnam exported to the U.S. last year, compliance risks may lead to more painful adjustments for Vietnam.

That, in turn, will hit U.S. consumers as Vietnam is their main source of cotton apparel, according to the U.S. Department of Commerce.

“Vietnam’s heavy reliance on cotton textile materials from China poses a significant risk of containing Xinjiang cotton, as the province produces over 90% of China’s cotton,” Sheng Lu, Director at the Department of Fashion and Apparel Studies at the University of Delaware, told Reuters.

He said it was unlikely Vietnam could drastically reduce this dependence, also because many manufacturers there are owned by Chinese investors.

An industry and a government official familiar with the matter confirmed that some Vietnamese suppliers may find it hard to comply with the new rules, either because they import cotton from Xinjiang or because they are unable to prove they do not.

The Federal Maritime Commission, the U.S. agency responsible for international ocean transportation, warned earlier this month of potential supply chain disruptions caused by UFLPA checks.

In a survey last year, nearly 60% of U.S. fashion industry managers said they were exploring countries outside Asia for their supplies as a reaction to the forced labor law.

Sheng Lu said it would be hard for U.S. firms to rapidly find alternative suppliers, therefore more checks on Vietnamese cargoes are to be expected.

Western companies should “make more significant efforts to map their supply chain, figure out where production at each stage happens and demonstrate adequate due diligence”, he said.

SHEDDING JOBS

Weaker demand has forced the industry, Vietnam’s biggest employer after agriculture, to shed nearly 3% of its 3.4 million workers since October, and contributed to an 11.9% drop in the country’s exports and a 2.3% decline in output in the first quarter of this year from a year earlier, slowing growth.

Roughly one in every three pairs of shoes that Nike and Adidas sell globally and 26% and 17% of their clothing, respectively, is made in Vietnam.

However Nike has significantly reduced its output of apparel and footwear in Vietnam despite the country remaining its main manufacturing hub, according to its latest annual report updated to May 2022. It did not reply to questions about UFLPA.

Adidas did not comment on UFLPA either, but said downsizing at its Vietnamese suppliers would respect local law.

“Vietnam continues to be among our major sourcing countries,” an Adidas spokesperson said.

Gap said it had no shipments detained.

Two officials from U.S. footwear and apparel industry trade associations said the new rules have had no major impact so far on Vietnam and blamed recent job cuts on lower global demand.

Major job cuts in Vietnam were under way at Pou Chen, a major supplier to Nike and Adidas, Reuters reported in February, at a time when it is planning a big manufacturing investment in India.

People were fired at a contractor of U.S. sportswear company Under Armour, and workers had their hours slashed at Regina Miracle International, a supplier of U.S. lingerie giant Victoria’s Secret, workers and executives told Reuters.

Those companies did not reply to Reuters’ questions.

“Normally, firms recruit new workers after Tet (Lunar New Year), but this year everything has gone the opposite,” said Nguyen Thi Huong, 45, who worked for Pou Chen for ten years and recently lost her job.

Source: Reuters